India is on the verge of an electric revolution. With the government aiming at 30% EV penetration by 2030 and vehicle electrification being a key element of the country’s decarbonization roadmap, power electronics has emerged to be among the very crucial and lucrative sectors in this transformation.

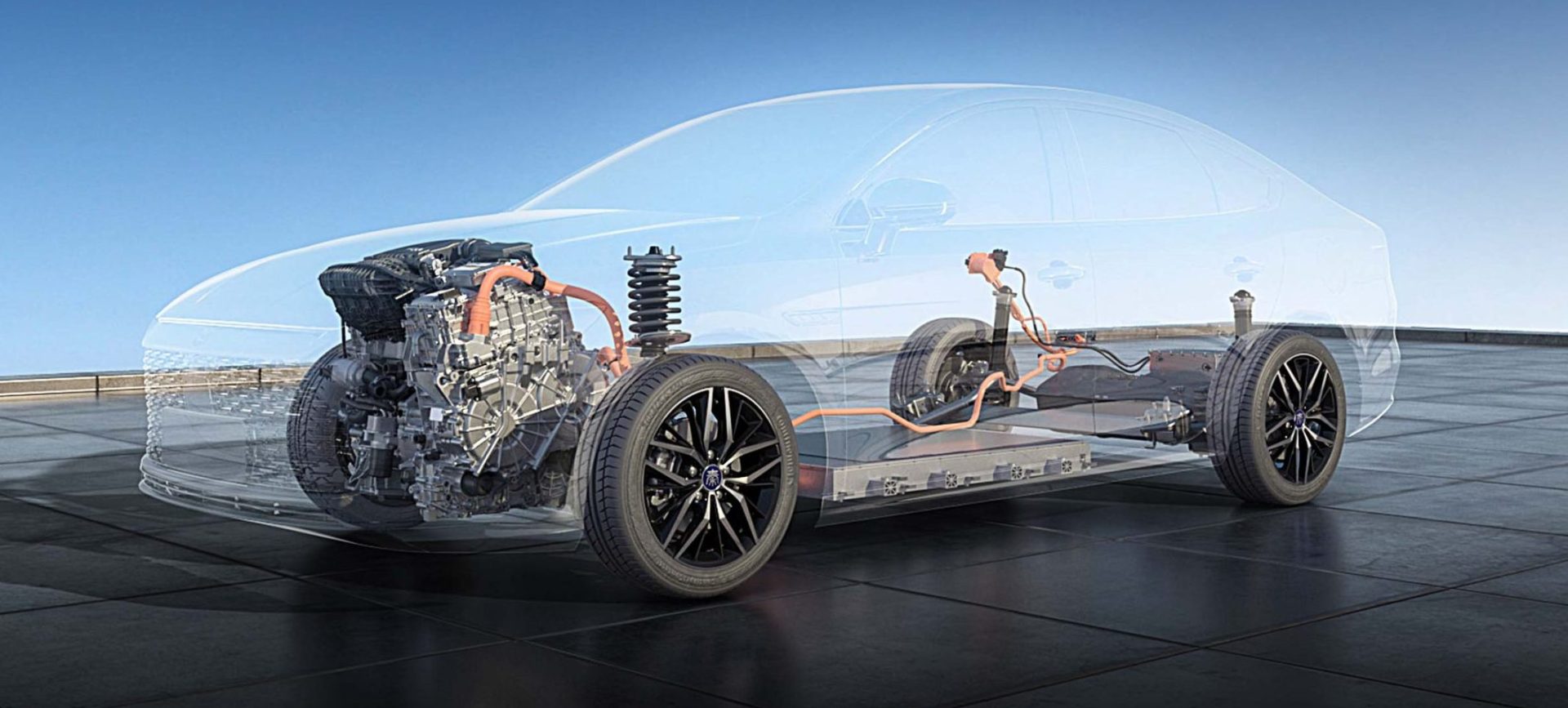

Power electronics, including inverters, onboard chargers, DC-DC converters, and battery management systems (BMS), are all essential to harness energy efficiently and maximize performance from EVs. Two-wheelers to electric buses, the whole spectrum of EVs depends on these systems to efficiently execute the conversion, controlling, and distribution of electrical energy.

As the global automotive industry accelerates toward electrification, power electronics have emerged as the driving force behind innovation in electric vehicle. These intelligent systems regulate energy flow, drive efficiency, fast charging, and ensure consistent performance across vehicle segments.

In 2024, the global market for power electronics in electric vehicles surged to USD 28.5 billion, and it’s poised for a meteoric rise projected to exceed USD 70 billion by 2030, driven by a robust CAGR of over 17%. In India, the automotive power electronics market was valued at USD 11.98 billion in 2024 and is projected to grow to USD 22.7 billion by 2034, with a CAGR of 6.6%.

As the Indian EV market grows further, power electronics is seeing extreme localization, investment flows, and technological upgrades-in a clear push towards high-value manufacturing and strategic partnerships.

India’s Five-Year Data Snapshot of the EV Power Electronics Market (2019-2024):

Between 2019 and 2024, India’s EV power electronics market evolved significantly. In 2019, the market size was ₹1,050 crore, driven by early adoption in fleet EVs and pilot policy programs. In 2020, it grew to ₹1,350 crore, supported by the FAME-II extension and state-level EV policies. By 2021, the market reached ₹1,870 crore, fueled by a surge in electric two-wheeler sales and increased component imports. In 2022, local development of BMS and inverters gained momentum, pushing the market to ₹2,720 crore. In 2023, investments in silicon carbide (SiC) production and EMS facilities elevated the market to ₹3,590 crore. The estimated value for 2024 is ₹4,450 crore, driven by the Make in India initiative and rising demand from electric light commercial vehicles (e-LCVs) and electric buses.

Current Market Conditions and Trends:

- Increasing Demand in the 2W and 3W

Electric two-wheelers and three-wheelers, but most of all in last-mile logistics, food delivery, and shared riding, make up over 80% of the EV sales in India. These require:

- Compact motor controllers, low-voltage

- DC-DC converters integrated

- BMS that is basic but efficient

Startups such as Ola Electric, Ather Energy, Yulu, and Euler Motors are engaged in localizing power electronics with design, testing and fabrication facilities within India.

- Localization Drive by the Government

The Indian government’s localization drive has prioritized power electronics under the Production Linked Incentive (PLI) schemes for Advanced Chemistry Cell (ACC) battery storage and auto components, designating them as verticals of strategic importance. These incentives aim to bolster domestic manufacturing of inverters and EV chargers, foster the development of EMS (Electronics Manufacturing Services) clusters, and establish robust testing and standardization infrastructure through institutions like ARAI and ICAT. States such as Tamil Nadu, Karnataka, Uttar Pradesh, and Telangana are rapidly emerging as key hubs for EV component production, reinforcing India’s ambition to become a global manufacturing powerhouse in electric mobility.

- SiC/GaN Technology

SiC and GaN technologies in India are still in their early stages, with manufacturers largely dependent on imports, through companies like Tata Elxsi, Servotech and Exicom are advancing local SiC packaging and vertical integration while some institutions are actively engaged in R&D for high-voltage inverter systems.

Segmentation:

- For two- and three-wheeler EVs, the market demands low-cost inverters, compact BMS, and DC-DC converters. This segment includes over 25 OEMs and a growing retrofitting market.

- Passenger EVs require 400V inverters, onboard chargers, and smart BMS, with companies like Tata and Mahindra driving demand.

- Commercial EVs, such as electric buses and e-LCVs, need rugged, high-voltage inverters and chargers.

- EV chargers require AC-DC converters and controller boards, with over 6,000 charging stations planned by FY 2026.

- Fleet and utility EVs—used by logistics firms, warehouses, and airport fleets—benefit from remote diagnostics and telematics-integrated BMS.

Key Indian Players:

- Tata Elxsi is working on inverters, BMS, and simulation software, with active development in SiC technology.

- Servotech Power focuses on EV chargers, onboard chargers, and DC-DC converters, and plans to manufacture SiC modules in India.

- Exicom specializes in battery packs, BMS, and electronics for light commercial vehicles, and is scaling up production for commercial EVs.

- Ola Electric is developing integrated powertrain systems, with in-house controller and BMS design underway.

- Delta India supplies power conversion systems to Tata Motors and public charging infrastructure.

Growth Drivers and Future Outlook:

Government initiatives and the flourishing private sector work together to provide electronics in India aesthetic power. Supporting localism, the drivers include PLI implementation schemes, import duties granted on the concept of localization, and, on the other hand, electrification of public transport under the PM e-Bus Sewa Yojana. Compliance by fleet operators has been instrumental in accelerating demand; some of them are leading corporate examples, such as Tata, Amazon, and Flipkart. Progressive state EV policies have been sowing the fertile grounds of land, subsidies, and demand-side incentives for manufacturing and innovation.

Opportunities (2025–2030):

The next five years open immense commercial opportunities. India shall become a regional export hub for EV inverters, especially to Southeast Asian and MENA markets. The indigenous development of GaN-based OBCs and DC-DC converters grows ever more attractive, backed by scalable EMS units crafted for startups and MSMEs. Also, modular powertrain kits for retrofitting ICE vehicles offer a good retrofit market in the Tier-2 and Tier-3 cities.

Challenges:

Despite building momentum, some barriers remain in place. As of now, India does not have any domestic entities manufacturing SiC wafers and the high import duties on the GaN components and control ICs continue to eat into margins. There is also an acute shortage of skills in automotive-grade electronics design, and the industry grapples with issues relating to standards and thermal management-a big concern for operating under tropical climates that India presents.

Commercial forecast: By 2030 & onward:

The Mutually Enforced Power Electronics Market in India is slated to exponentially shoot past ₹20,000 crore by around 2030, with over 10 million EVs present on roads of India. Demand would come through the mid-range inverter platforms for domestic as well as for export purposes, with the scaling up of Tier-2 and Tier-3 supplier networks alongside deeper MSME integrations into the EV value chain.

Conclusion:

Power electronics are taking center stage in India’s fast charging electric vehicle landscape, which will support everything from 750V electric buses on major expressways to low-cost e scooters in Tier-2 cities. As vehicle electrification scales up, power electronics will determine not only the operational efficiency and reliability of EVs but also the worldwide competitiveness of India’s EV manufacturing ecosystem.

With supportive government policies in place, a large domestic demand base, growing R&D capabilities, along with increased attention from domestic and global investors, India stands on the cusp of becoming a global hub for EV power electronics manufacturing and innovation.

For OEMs, component makers, and tech entrepreneurs, the window of opportunity is now. Investment in localized, scalable, and intelligent power electronics solutions will reduce import dependency and costs while paving the way to assure dominance in one of the fastest-growing clean tech markets globally.

The future of India’s EV growth, and development, is not just about batteries and motors. It’s about the invisible engine that makes it all possible i.e power electronics.